Checking for the whole family!

All of our Checking Accounts make it easy to protect your money. Learn more!

Free

Checking

With Free Fraud Detection

Teen

Checking

Made for Kids 13 to 17

Interest

Checking

Competitive Rates

Fresh Start Checking*

Get a Second Chance

Open a Checking account Online

Buy Now Pay Later

Your West Community debit card purchases may qualify for Buy Now Pay Later offers, allowing you to split your purchases into smaller payments over time.

Order Checks

Login to Digital Banking to securely and accurately order new checks. Not enrolled? You can visit our supplier and enter your information manually.

All Checking accounts include these free fraud detection tools:

Custom Real-Time Account Monitoring

- Transaction alerts to know immediately when activity occurs on your accounts

- Scheduled daily balance alerts

- Funds transfer alerts

- Online and Mobile Banking login alerts

Debit Card Controls

- Debit Card use alerts

- Turn your cards on and off

- Set spending limits

- Limit card use regionally and by merchant type

- Block international transactions

- Set travel notifications

Monitor Credit Activity1

- Credit activity change alerts to help you monitor for unsolicited changes to your credit report

- 24/7 credit score access

- Monthly credit reports

- Even initiate disputes from our digital banking tools

Learn more about PROTECTING YOURSELF from fraud

1) Download of the West Community Mobile Banking app or

enrollment in Online Banking required. Credit score monitoring not available for account

holders under 18 years of age.

2) A $5.00 monthly fee applies if balance drops below

$2,500. Fee not applicable to members age 65+. Free checks are available to senior members age

65+ when ordered through a credit union branch. Online ordering not available.

*Shared Branch transactions not permitted. After 12 months of satisfactory account history, an account review can be requested to determine if qualifications are met to convert to a Free Checking or Interest Checking Account. A $400 Overdraft Privilege available after three months of satisfactory account history.

CHECKING COMPARISON

| BENEFITS | FREE CHECKING | INTEREST CHECKING | TEEN CHECKING | FRESH START CHECKING |

|---|---|---|---|---|

| FREE Credit Report1 | ||||

| Mastercard® Debit Card | ||||

| Debit Card security | ||||

| FREE Digital Banking | ||||

| FREE Bill Pay | ||||

| FREE Mobile Check Deposit2 | ||||

| 30,000 surcharge FREE ATMs | ||||

| Overdraft Protection Options | Limitations3 | |||

| Shared Branch Access | 4 | |||

| Unlimited Check Writing | ||||

| Pays Interest | ||||

| FREE Checks | 5 | |||

| Min. Deposit | $25 | $25 | $25 | $25 |

| Monthly Fee | $106 | |||

| Min. Balance Fee | $57 | |||

| Min. Balance Requirement | $2,5007 |

1) Enrollment in Digital Banking required. Credit score

monitoring not available for account holders under 18 years of age.

2) Download of the West

Community Mobile Banking App required.

3) A $400 Overdraft Privilege available after three

months of satisfactory account history.

4) Shared Branch transactions not permitted.

5)

Free to members 65+ when ordered directly through a credit union branch.

6) After 12 months

of satisfactory account history, an account review can be requested to determine if

qualifications are met to convert to a Free Checking or Interest Checking Account.

7) A

$5.00 minimum balance fee applies if balance drops below $2,500. Fee not applicable to members

age 65+

Open a Checking Account Today

Open your checking account online or visit your local branch.

OVERDRAFT COVERAGE OPTIONS

Life happens! West Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help.

Savings Transfer – To save you time and money, West Community Credit Union has the ability to automatically transfer available funds from your savings account to your checking account to cover insufficient funds. A transaction fee of $5.00 will be applied to each transfer.

Overdraft Line of Credit – Apply for a personal Overdraft Line of Credit Loan for your checking account to cover insufficient funds. A $5.00 transaction fee will apply for each day that an overdraft transfer(s) is made into your account.

Annual Percentage Rate of 12.9% APR. All Lines of Credit are subject to approval with an Annual Percentage Rate. Terms and conditions may vary based on creditworthiness qualifications. Rates, terms, and conditions are subject to change. Refer to a Member Service Consultant for additional information.

Account Management Resources:

Link to another deposit account you have at West Community Credit Union

$5 fee per transfer

Overdraft Line of Credit

$5 fee per day

+ 12.9% APR

If you have any questions about Overdraft Coverage, please call us at (636) 720-2400 or (800) 500-6860, or visit a branch.

1 Contact us at (636) 720-2400 or

[email protected], or visit a branch to sign up or apply for these services;

2subject to credit approval;

3 A $5.00

transaction fee will apply for each day that an overdraft transfer(s) is made into your

account.

4Annual Percentage Rate (subject to 12 C.F.R. §

1026.16[b])

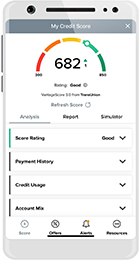

FREE CREDIT SCORE ACCESS & ALERTS

Your credit score affects every aspect of your financial life – from loan rates to cost of insurance. The better your score, the more you save. That’s why we’ve made it easy to monitor your credit score and activity by offering 24/7 access to it for FREE in our Mobile Banking App and in Online Banking.

- FREE Unlimited access to your credit score

- FREE Monthly credit reports

- FREE Daily credit alerts to help you monitor for fraud

- FREE Tips for improving your score

- FREE Opportunities to save

- See the average credit score within your ZIP code

- Review how your credit score has changed over time

- Initiate credit report disputes from the app

Login and Take Control

Secure, free access to your credit score is only one way our

digital banking services put you in charge. Login to Online Banking today or download our Mobile

App for secure 24/7 account access. Pay bills, transfer money, view balances, monitor your money

with a variety of account and card alerts, and even deposit checks with the Mobile App!

Secure, free access to your credit score is only one way our

digital banking services put you in charge. Login to Online Banking today or download our Mobile

App for secure 24/7 account access. Pay bills, transfer money, view balances, monitor your money

with a variety of account and card alerts, and even deposit checks with the Mobile App!

Open a Checking Account Today

Open your checking account online or visit your local branch.